Global supply chains have been reshaped in the wake of pandemic disruptions, escalating tariffs, and geopolitical tensions. Manufacturers that once relied on distant factories are rethinking their strategies. The plastics industry, in particular, has been at the forefront of this shift, with an increasing number of companies choosing Mexico as their manufacturing base in 2025.

So why are plastics companies flocking south of the U.S. border? The answer lies in a combination of cost advantages, proximity, trade incentives, skilled labor, and infrastructure that together offer a compelling alternative to offshoring. This article explains the key drivers behind the trend and how partners like KS Group leverage their injection molding facilities in Mexico to give customers a strategic nearshore solution.

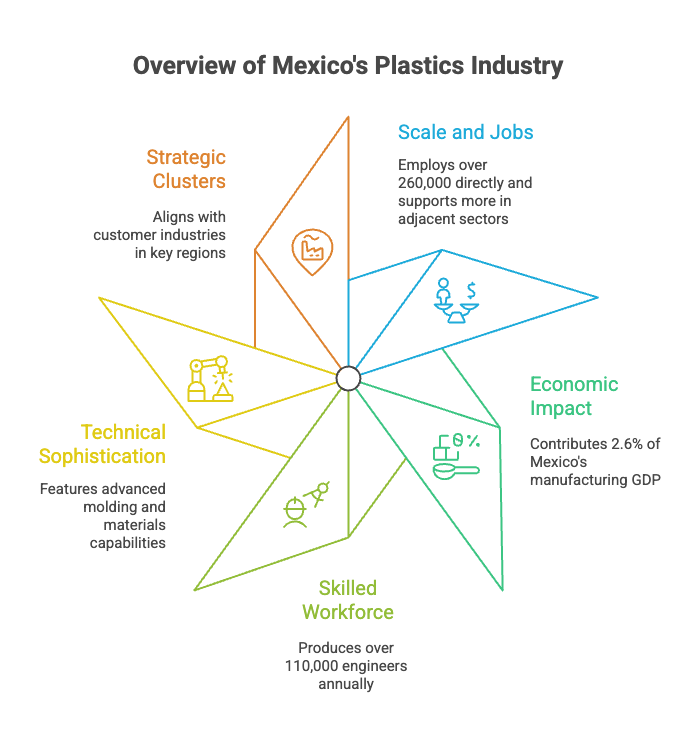

A Mature and Growing Plastics Ecosystem

Mexico’s plastics industry isn’t an emerging upstart—it’s a mature, sophisticated ecosystem integrated with the country’s largest manufacturing sectors. Injection-molded plastics support the automotive sector (around 30% of the market), the electronics sector (~6%), packaging and consumer goods (48%), and a growing medical device industry.

Key statistics illustrate the depth of this ecosystem:

- Scale and jobs: The plastic manufacturing industry employs over 260,000 people directly and supports many more in adjacent sectors.

- Economic impact: Plastics contribute 2.6% of Mexico’s manufacturing GDP and make Mexico the 11th largest producer and 12th largest consumer of plastics globally.

- Skilled workforce: More than 110,000 engineers graduate in Mexico each year, feeding a talent pipeline skilled in advanced manufacturing techniques.

- Technical sophistication: Mexico hosts over 265 specialized mold and die shops, and capabilities range from high‑precision injection molding and multi‑shot molding to insert molding and advanced materials.

- Strategic clusters: Major plastics hubs align with customer industries—the Bajío region (Guanajuato, Querétaro, San Luis Potosí) supplies automotive OEMs; the Northern Border (Baja California, Chihuahua, Nuevo León) serves electronics and medical device companies; and Central Mexico (Estado de México, Puebla) supports consumer goods.

These statistics show that Mexico isn’t just a low‑cost option; it’s a complete ecosystem capable of meeting the demanding quality and volume requirements of global plastics manufacturers.

Nearshoring and Cost Advantages

One of the most obvious drivers of Mexico’s appeal is cost. While China once offered the lowest labor rates, Mexico now competes aggressively. In 2025 the average hourly manufacturing wage in Mexico is roughly US$4.90, compared with about US$6.50 in China—a 25 % savings. When compared with the United States, some analyses estimate Mexican labor costs to be around 70 % lower. Lower wages alone, however, don’t tell the whole story. Nearshoring delivers value across multiple dimensions:

- Shorter supply chains: Transporting a mold or production run from Asia can take 4–6 weeks by sea. From Mexico, truck or rail delivery typically takes just 1–5 days. Same‑day deliveries are often possible for U.S. customers.

- Reduced shipping costs and risk: Global maritime freight prices rose over 500 % during the pandemic. Nearshoring mitigates exposure to port congestion, container shortages, and geopolitical disruptions.

- Agility and communication: A shared time zone and short travel distances allow real‑time problem solving and rapid design iterations.

- GDP boost: Economists estimate that nearshoring could add 3% to Mexico’s GDP in the next five years, underscoring its macroeconomic importance.

When combined, these advantages often outweigh the slightly higher direct labor costs compared with Asia. For plastics companies with tight deadlines, complex tooling, and the need for frequent collaboration, Mexico’s proximity translates into tangible savings and reliability.

Trade Agreements and Investor-Friendly Policies

Mexico’s government actively cultivates a manufacturing‑friendly environment. The United States–Mexico–Canada Agreement (USMCA) replaced NAFTA and exempts products meeting its rules of origin from many U.S. tariffs. Chinese imports, by contrast, face tariffs of up to 25 %. Beyond USMCA, Mexico has 14 free‑trade agreements with about 50 countries, giving companies preferential access to 60 % of global GDP. In fact, Mexico has approximately forty‑three trade agreements in total—more than any other country.

The government’s IMMEX program (formerly the maquiladora program) further enhances competitiveness by allowing foreign companies to import raw materials duty‑free as long as finished goods are exported. This flexibility, coupled with competitive labor rates, encourages companies to operate assembly and molding facilities close to their main markets. Meanwhile, 368 government‑certified industrial parks, 62 % of them foreign‑owned, provide secure, well‑equipped sites for injection molding with benefits like steady power, waste management, and tax incentives.

Strong intellectual property laws, aligned with U.S. and Canadian standards, further reassure companies that their tooling and designs are protected. All told, Mexico’s regulatory framework removes many of the risks associated with operating abroad.

Skilled Workforce and Industry 4.0 Adoption

Mexico’s manufacturing strength stems from its people. In addition to the 110,000 engineers who graduate annually, thousands of technicians, operators, and quality engineers bring deep practical expertise in plastics processing. Many companies operate under the IMMEX program, which employs about 2.94 million workers across 5,220 manufacturers.

This talent is increasingly augmented by Industry 4.0 practices. Factories are investing in automation, robotics, and advanced data analytics to boost productivity and quality. By embracing digitization, Mexican injection molders can compete on precision and consistency with global leaders. For plastics companies, this means access to a workforce proficient in lean manufacturing, SMED (single‑minute exchange of die), and smart systems that reduce changeover times and enable rapid scaling. These innovations help offset rising wage pressures while ensuring that products meet stringent quality requirements.

Infrastructure and Supply Chain Resilience

Another advantage Mexico offers is a robust physical and logistical infrastructure. Deep‑water ports, modern highways, extensive rail networks, and efficient customs procedures support just‑in‑time deliveries to U.S. customers. Mexico also hosts 368 industrial parks across 24 states, many designed specifically for injection molding and equipped with clean rooms, testing labs, and automation equipment. These facilities reduce lead times for tooling and part production, while co‑location with automotive and electronics plants minimizes inventory holding.

As companies learned during the pandemic, long global supply chains are brittle. Nearshoring simplifies shipping routes—often “factory to truck to your door”—and reduces the number of handoffs, which translates into fewer points of failure. This resilience is especially valuable in plastic molding, where tooling delays can stall entire product launches.

Why KS Group Invests in Mexico

For plastics companies seeking to leverage Mexico’s advantages, a partner with local expertise is invaluable. KS Group operates a 105,000‑square‑foot molding and assembly plant in Tijuana that serves consumer products, electronics, transportation, healthcare, and agriculture industries. The facility houses 20 injection molding machines ranging from 150 to 1,800 tons, a 4,500‑square‑foot tool room, fully equipped quality labs, and class 7 and 8 clean rooms. Integrated robotics, moldflow analysis, laser marking, ultrasonic welding, and other advanced capabilities allow KS Group to offer nearshore manufacturing with the same precision and quality customers expect from its U.S. facilities.

By choosing KS Group’s Tijuana facility, clients benefit from reduced transit times, flexible production scheduling, and lower logistics costs. KS also maintains state‑of‑the‑art facilities in San Leandro and San Jose, ensuring seamless coordination between domestic and Mexican operations. Combined with medical injection molding and device manufacturing expertise and rigorous quality assurance processes, KS Group provides a vertically integrated, compliant and reliable supply chain.

Balancing the Opportunities and Challenges

Although Mexico offers many advantages, it isn’t without challenges. Surveys suggest that nearly 80 % of business leaders view Mexico’s rule of law as a hurdle to attracting foreign direct investment. Rising demand for skilled workers could drive wages upward, and compliance with USMCA rules of origin requires careful supply chain planning. Nevertheless, for plastics companies looking to de‑risk their operations, reduce lead times, and access a sophisticated manufacturing base, Mexico remains an attractive choice. By partnering with established molders and maintaining rigorous quality and compliance systems, businesses can navigate these challenges and unlock significant benefits.

The shift toward Mexico reflects a broader rebalancing of global manufacturing. For plastics companies in 2025, Mexico combines cost competitiveness, strategic proximity, favorable trade policies, skilled labor, and a robust industrial ecosystem. The country’s injection molding industry is large, growing, and integrated with major export sectors. Nearshoring to Mexico reduces shipping time, increases supply chain resilience, and allows real‑time collaboration, while trade agreements and programs like USMCA and IMMEX minimize tariff burdens. A skilled workforce and investments in Industry 4.0 ensure that product quality rivals that of any global hub.

Companies that embrace Mexico’s strengths can gain a decisive competitive edge. Whether you’re looking to streamline supply chains, expand capacity, or access new markets, the right partner is critical. KS Group provides the facilities, expertise and quality systems necessary to make Mexico not just an alternative but a strategic cornerstone of your plastics manufacturing strategy.